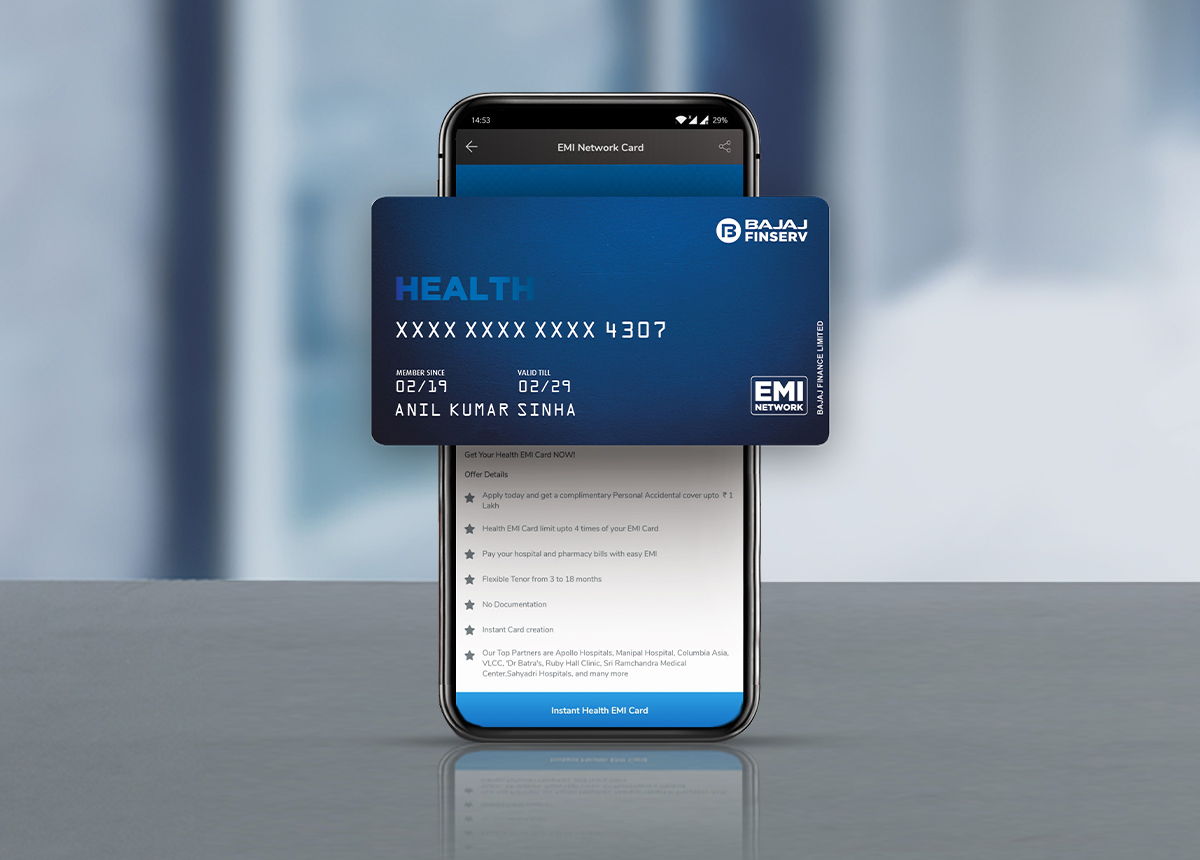

Medical emergencies are unpredictable, and during this critical hour, you must have sufficient funds to initiate treatment without delay. You need to have adequate finances to bear subsequent medical expenses as well. A Bajaj Health EMI card lets you get relaxation from all these financial worries.

You can use this card to convert all your medical expenses of up to Rs. 4 Lakhs into easy no-cost EMIs, starting the following month. However, it is necessary that you know how to use a Bajaj Health EMI card to leverage this benefit.

Click here – Ultimate guide for electric bike insurance

How to Use Bajaj Finserv Health EMI Card

The health EMI card helps you get a predetermined credit limit which can go up to Rs. 4 Lakhs. To get the required medical facility using your Bajaj Finserv Health EMI card, you just need to avail treatment from the healthcare partners of the card issuer. There are more than 5,500 partners across over 1,000 cities in India.

Following are the easy steps you need to follow to convert your bills into EMIs:

Step 1: Visit a hospital partnered with Bajaj Finserv to get the appropriate treatment

Step 2: Convey to the concerned authority that you intend to pay your bills using your Bajaj Finserv Health EMI card

Step 3: Provide the card details and OTP when asked

Step 4: Select repayment tenure at your convenience

Upon completion of these easy steps, you will be able to get your medical costs covered. Your EMI bills will be generated from the following month.

What is the No Cost EMI Benefit of Bajaj Finserv Health EMI Card?

You do not need to pay any interest rate on the utilised amount as the financing through the Bajaj Finserv Health EMI card comes with no-cost EMI facility. As a result, you do not need to pay any additional amount to the card issuer, making the instalments relatively cheaper and affordable.

While leveraging this financing option, you will have to first choose tenure of the debt which can be in the range between 3 and 24 months. The total medical bill will get equally divided into the repayment period you choose. For example, if your total treatment expense is Rs. 1,20,000 and your tenure is 24 months, your EMI amount will be Rs. 5,000.

After knowing how to use a Bajaj Finserv Health EMI card to convert medical bills into no-cost EMIs, you should be aware of the different variants of this card and their features.

Click here – How to Make Sure Your Email Marketing is HIPAA Compliant

Variants of Bajaj Finserv Health EMI Cards and Their Features

There are two types of Bajaj Finserv Health EMI cards tailored for specific requirements. These are as follows:

-

Bajaj Finserv Health EMI Network Card Gold

Listed below are different aspects you need to know about this card:

| Card Charges | Rs. 707 (Including Taxes) |

| Credit Limit | Rs. 4 Lakhs |

| Discounts | 45+ Free laboratory tests done from over 2,400 partnered hospitals/clinics and preventive healthcare check-ups worth Rs. 3,000 |

| Teleconsultation | Up to 10 free teleconsultations; worth Rs. 5,000 |

The cumulative wellness benefit under this health card is equivalent to Rs. 8,000.

-

Bajaj Finserv Health EMI Network Card Platinum

Following are different features you need to know about this card:

| Card Charges | Rs. 999 (Including Taxes) |

| Credit Limit | Rs. 4 Lakhs |

| Discounts | 45+ Free laboratory tests done from over 2,400 partnered hospitals/clinics and preventive healthcare check-ups worth Rs. 3,000 |

| Teleconsultation | Up to 10 free teleconsultations; worth Rs. 5,000 |

| Lab and OPD Benefits | Lab-test and OPD done by any doctors, or from any labs and hospitals in India; worth Rs. 2,500 |

The cumulative wellness benefit under this health card is worth Rs. 10,000.

Benefits of Bajaj Finserv Health EMI Card

You can get the following benefits if you have the health card:

- You can pay up to Rs. 4 Lakhs of your medical bills through this card and repay them in convenient instalments.

- You can convert the treatment expenses of all your family members through your card. It is not necessary to purchase separate cards for everyone.

- The card issuer lets you activate your card instantly from the mobile app.

- The application process for this card is completely paperless.

- The joining fee is payable to the card issuer only once.

- The repayment tenure is flexible. You can choose your tenure between 3 and 24 months according to your capacity.

You also should be aware of how to apply for a Bajaj Finserv EMI Network card.

Steps to Apply

You need to simply follow the step-by-step process mentioned below to get your own Bajaj Finserv Health EMI card:

Step 1: Go to the e-marketplace that lets customers get the Bajaj Finserv Health EMI card

Step 2: Visit the page for health card

Step 3: Click on ‘Apply Now’

Step 4: Enter the required details including your name, contact number, etc.

Step 5: Go through the eligibility criteria and the offers

Step 6: Complete the KYC procedure online through your Aadhaar card

Step 7: Pay the joining fee according to your selected card

Step 8: Click on the ‘Activate Now’ button

After the e-mandate process is completed from the end of the card issuer, your card will become active and you can access all its benefits.

Now after knowing how to use a Bajaj Finserv Health EMI card, you can reduce your time and effort in arranging the finance required for your treatment. It will allow you to split all your medical bills into no-cost EMIs which you will have to repay starting from the upcoming month. You can even pay for the medical bills of any of your family members using your own card.